Many businesses don’t fail because they are unprofitable; they fail because they run out of cash. Understanding and mastering how to manage cash flow in a small business is one of the most critical skills for any entrepreneur. It’s the difference between navigating a temporary slump and shutting down completely. Whether you’re just exploring small business ideas or looking for ways on how to scale a business successfully, managing your cash flow is a foundational pillar of success.

Effective cash flow management is the process of monitoring, analyzing, and optimizing the money moving in and out of your business. It ensures you have enough cash on hand to meet your financial obligations, from paying suppliers and salaries to investing in growth. Think of it as the lifeblood of your company. A healthy business model and a profitable product line are great, but without sufficient cash to cover daily operations, even the most promising venture can crumble.

This guide will walk you through everything you need to know about how to manage cash flow in a small business. We’ll explore why it’s so important, provide ten actionable strategies to improve it, and review the best tools to help you stay in control. By the end, you’ll have a clear roadmap to build a financially resilient business that’s prepared for both challenges and opportunities.

Table of Contents

What is Cash Flow Management?

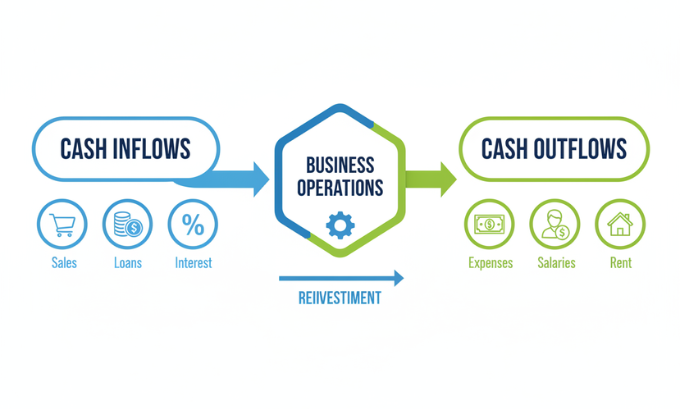

Cash flow management involves tracking every dollar that comes into your business (inflows) and every dollar that goes out (outflows). The goal is simple: ensure that you have enough money available at all times to keep the lights on and the business running smoothly.

- Cash Inflows: This is the money your business receives. It primarily includes revenue from sales, but can also cover payments from accounts receivable, loan proceeds, and interest earned on investments.

- Cash Outflows: This is the money your business spends. Outflows include everything from paying for inventory and shipping to covering rent, salaries, marketing costs, and website maintenance.

A cash flow statement is the financial document that tracks these movements over a specific period, such as a week, month, or quarter. By subtracting your total outflows from your total inflows, you can determine your net cash flow. If inflows are greater than outflows, you have a positive cash flow. If outflows exceed inflows, you have a negative cash flow.

Mastering this process is not just a good business practice; it’s a crucial skill that impacts every aspect of your operations, from strategic planning to day-to-day stress levels. If you’d like to learn more about the broader financial concepts that support a healthy enterprise, exploring resources on Monarch Networth Capital can provide additional context.

Why Effective Cash Flow Management is Crucial

Staying on top of your cash flow offers more than just financial stability; it provides strategic advantages that can define your business’s trajectory. Here’s why it’s so important.

- Predict and Prevent Shortfalls: Proactive cash flow management helps you spot potential cash gaps before they become crises. This foresight allows you to take corrective action, like delaying a non-essential purchase or running a flash sale to boost revenue, preventing a crippling shortage.

- Reduce Entrepreneurial Stress: A significant source of stress for business owners is the uncertainty of meeting financial obligations. Knowing your exact cash position, even if the outlook is challenging, empowers you to make informed decisions and feel in control.

- Identify Growth Opportunities: A clear view of your cash flow tells you precisely when you can afford to invest in growth. While a profit and loss statement might show you’re profitable, your cash flow forecast reveals the actual cash available for expanding your product line, hiring new staff, or investing in better digital marketing.

- Gain Leverage with Lenders and Suppliers: When you need a line of credit or more flexible payment terms, a detailed cash flow projection is your best friend. Financial institutions and suppliers are far more willing to work with a business that demonstrates clear financial planning and a concrete repayment strategy.

- Improve Budgeting Accuracy: Budgets are often based on optimistic goals, but cash flow projections are grounded in reality. They show you what’s actually happening with your money, allowing you to make necessary adjustments and create more accurate financial plans.

10 Strategies for Effective Small Business Cash Flow Management

Improving your cash flow doesn’t have to be complicated. By implementing a few strategic habits, you can build a more resilient and financially healthy business.

1. Prepare a Cash Flow Forecast

The cornerstone of effective cash flow management is cash flow forecasting. This process involves predicting your cash inflows and outflows over a future period, typically on a weekly or monthly basis. Whether you use a spreadsheet or a dedicated financial tool, your forecast should account for all anticipated income and expenses.

An accurate forecast allows you to make better decisions about spending, investment, and growth. For instance, if you see a large, unavoidable expense coming up next month, your forecast gives you time to adjust your spending now to ensure you have enough cash to cover it.

2. Focus on Smart Inventory Control

Your inventory is cash sitting on a shelf. Effective inventory control ensures that your stock levels align with customer demand, freeing up cash that would otherwise be tied up in slow-moving products.

Conduct regular ABC analyses to identify your best-selling items and your “dead stock.” Keep more of what sells quickly and consider discounting items that aren’t moving to convert them back into cash. For businesses in the retail sector, leveraging a robust warehouse management software for small business can automate much of this process.

3. Lease Equipment Instead of Buying

For many small businesses, large capital expenditures can strain cash flow. When you need new equipment, consider leasing instead of buying. Leasing allows you to make smaller, predictable payments over time, preserving your cash for daily operational needs. It’s a common practice in what is a business finance to prioritize liquidity. Plus, lease payments are typically tax-deductible business expenses.

4. Optimize Your Invoicing Process

The faster you get paid, the healthier your cash flow. Send invoices immediately after delivering a product or service. If you operate on a monthly billing cycle, communicate a switch to an on-demand model with your clients. You can also incentivize early payments by offering a small discount. Tools like Shopify Bill Pay can help you manage vendor invoices efficiently, allowing you to view, schedule, and pay bills seamlessly.

5. Create Alternative Revenue Streams

Don’t put all your eggs in one basket. If your primary revenue stream is under pressure, explore alternative revenue streams to diversify your income. This could mean adding new products or services, offering digital products like e-books, or exploring different sales channels. For brick-and-mortar stores, introducing options like “buy online, pickup in-store” (BOPIS) or local delivery can create new cash inflows. Exploring various best e-commerce business ideas for beginners can spark inspiration.

6. Take Advantage of Early Pay Discounts

Just as you can offer discounts for early payments, your suppliers may offer them to you. Ask your vendors if they have early payment discount programs. Paying a little sooner can save you money and preserve your working capital over the long run. It also helps build stronger, more reliable supplier relationships.

7. Negotiate Favorable Supplier Terms

If you have a strong, long-standing relationship with your suppliers, don’t be afraid to negotiate more favorable payment terms during tight periods. Many suppliers are willing to offer a payment extension or a flexible plan to retain a reliable customer. Open and honest communication is key. A history of timely payments gives you the leverage to ask for flexibility when you need it most. For those looking to optimize their supply chain further, exploring an ERP for small business can integrate these processes.

8. Open a High-Interest Business Savings Account

If you have surplus cash, put it to work. A high-yield business savings account allows you to earn interest on money you don’t need for immediate expenses. Look for an account that is easily accessible, has a low minimum deposit, and offers a competitive interest rate. This strategy improves your cash position month over month and helps build a cushion for the future.

9. Build and Maintain an Emergency Fund

Every business needs an emergency fund. This is a cash reserve set aside specifically for unexpected expenses or economic downturns. It ensures you have the financial flexibility to weather challenges without disrupting your daily operations or taking on unnecessary debt. A good starting point is to save three to six months’ worth of operating expenses.

10. Invest in the Right Software

Modern software can automate many of the tedious tasks associated with cash flow management. Accounting platforms can digitize data entry, while specialized tools can track expenses in real time, generate financial reports, and provide planning insights. For example, AI-powered platforms can analyze banking data to create highly accurate cash flow forecasts. This automation frees up your time to focus on strategy and growth. To understand more about how technology can reshape your operations, consider reading about digital transformation strategies.

Tools for Streamlining Cash Flow Management

From simple spreadsheets to advanced financial platforms, a wide range of tools can help you master your cash flow.

My Experience: From Spreadsheet Chaos to Clarity

When I launched my first e-commerce store, I managed everything with spreadsheets. I tracked sales, expenses, and inventory manually. For a while, it worked. But as the business grew, so did the complexity. I was spending hours every week buried in rows and columns, trying to piece together a clear financial picture. One month, a large, unexpected customs fee coincided with a slower sales period, and I nearly ran out of cash to pay my suppliers. That was my wake-up call.

I invested in an integrated financial platform that synced with my bank and e-commerce store. Suddenly, I had a real-time dashboard showing my cash position. I set up automated forecasts that helped me anticipate future shortfalls and plan accordingly. It was a game-changer. The platform wasn’t just a tool; it was a partner in my business’s financial health, much like how a service like LinkLuminous becomes a partner in your digital visibility.

What I Liked:

- Real-Time Data: No more waiting until the end of the month. I could see my cash flow daily.

- Automated Forecasting: The predictive features helped me make smarter spending decisions.

- Time Savings: I reclaimed hours every week that I could pour back into growing the business.

Areas for Improvement:

- Initial Setup: Integrating all my accounts took some time and effort upfront.

- Cost: Subscription-based software is an ongoing expense, unlike a one-time spreadsheet setup.

Here are some of the most effective tools available for businesses of all sizes:

Google Sheets

For many startups and small businesses, the best tool is a free one. Google Sheets is a powerful and flexible option for creating a manual cash flow statement. You can customize your spreadsheet to be as simple or as detailed as you need. The hands-on process of building and updating your own spreadsheet also forces you to deeply understand your business’s financial situation. You can use a free cash flow projection template to get started.

Shopify Balance and Cash Flow Calculator

If you run an e-commerce business on Shopify, their native tools are incredibly valuable. Shopify Balance is a free financial account that integrates directly with your store, giving you a central place to manage your money. You can also use the Shopify cash flow calculator to estimate your future cash flow by entering projected inflows and outflows.

Dedicated Financial Platforms

- Tesorio: This platform offers advanced tools like unified bank account reports, cash forecasting, and analytics. Tesorio integrates with your existing financial systems to provide a real-time dashboard of your cash flow performance.

- Jirav: As a comprehensive financial management platform, Jirav integrates cash flow analysis with your business’s broader financial picture. It includes customizable reports, intuitive dashboards, and automation features.

- Kolleno: Specializing in accounts receivable, Kolleno helps you get paid faster and automate collection processes, directly improving your cash inflows.

- Causal: This is a dedicated financial modeling tool that goes beyond cash flow to include hiring plans, consolidations, and other complex financial scenarios, presented in easy-to-understand visualizations.

| Tool | Best For | Key Feature | Pricing Model |

|---|---|---|---|

| Google Sheets | Startups & DIY management | Fully customizable, free | Free |

| Shopify Tools | Shopify merchants | Seamless integration with store data | Free with Shopify plan |

| Tesorio | Growing businesses | Real-time unified cash flow dashboard | Subscription |

| Jirav | Holistic financial planning | Integration with overall business financials | Subscription |

Real-World Example: Turning Cash Flow Around

Let’s look at a practical example. Neil runs a small grocery store. He faced a sudden cash flow crunch due to a dip in revenue. Instead of panicking, he took strategic action.

- He renegotiated supplier terms, extending his payment deadlines by 30 days.

- He diversified with alternative revenue streams, adding an in-store deli, taking online orders via a Shopify store, and partnering with local brands.

- He leveraged accounting software to optimize his inventory management.

Within three months, Neil’s operating cash flow increased by 30%. He then solidified this newfound stability by establishing an emergency fund and opening a high-interest savings account. Neil’s story demonstrates that with the right strategies, any small business can overcome financial hurdles and build a sustainable future. Setting clear objectives was key, much like the process of goal setting for success.

Your Path to Financial Stability

Mastering cash flow management is not an overnight task, but it is an achievable and essential goal for any small business owner. It requires diligence, foresight, and a willingness to adapt. By implementing the strategies outlined in this guide—from forecasting and inventory control to leveraging the right software—you can take control of your finances and build a business that is resilient enough to weather any storm. Start today by getting organized, and you’ll be well on your way to securing your business’s long-term success. For those interested in advanced financial strategies and market insights, exploring Monarch Networth Share Price analysis can provide a deeper understanding of how larger financial entities operate.

Frequently Asked Questions (FAQs)

What is a cash flow management plan?

A cash flow management plan is a document that outlines how a business will monitor, analyze, and optimize its cash inflows and outflows. Its purpose is to ensure the business has enough funds to meet its financial obligations at all times.

What are the main tasks of cash flow management?

The key tasks include forecasting cash flow, monitoring collections and payments, managing expenses, and regularly analyzing your cash flow statement to compare actual results against your projections.

What’s the difference between cash flow management and cash management?

Cash management focuses on the collection, handling, and usage of cash. Cash flow management is a broader concept that involves analyzing and optimizing the movement of cash into and out of the business to ensure liquidity and financial stability.

Is there a single best way to manage cash flow?

No single strategy works for every business. The best approach is a combination of tactics tailored to your specific industry and business model. Key strategies include preparing a forecast, managing inventory, optimizing invoices, and building an emergency fund.

How much should I have in my emergency fund?

A good rule of thumb is to have enough cash in your emergency fund to cover three to six months of essential operating expenses. However, the exact amount will depend on your industry’s volatility and your business’s specific financial obligations.

Can I manage cash flow with just a spreadsheet?

Yes, especially for new or small businesses. A well-organized spreadsheet can be a very effective tool for tracking and forecasting cash flow. As your business grows, you may want to transition to dedicated software for more automation and advanced features.

How can I improve my cash flow quickly?

To improve cash flow in the short term, focus on accelerating your receivables (getting paid faster), delaying payables where possible without harming supplier relationships, and cutting any non-essential expenses. Running a promotion or flash sale can also provide a quick cash injection.

Author Bio & References

This article was authored by a team of business strategists and financial analysts with extensive experience helping small and medium-sized enterprises (SMEs) navigate the complexities of financial management. Our insights are drawn from years of hands-on experience in business scaling, market analysis, and financial consulting.

For further reading and to deepen your understanding of the concepts discussed, we recommend the following resources:

- Shopify Blog: Cash Flow Management

- Ponta.in: How to Scale a Business Successfully

- GoGoNihon.jp.net: Low-Cost Marketing Ideas for Startups

- Mumbai Times: What is a Business?

- TechBullion: Digital Transformation Strategies